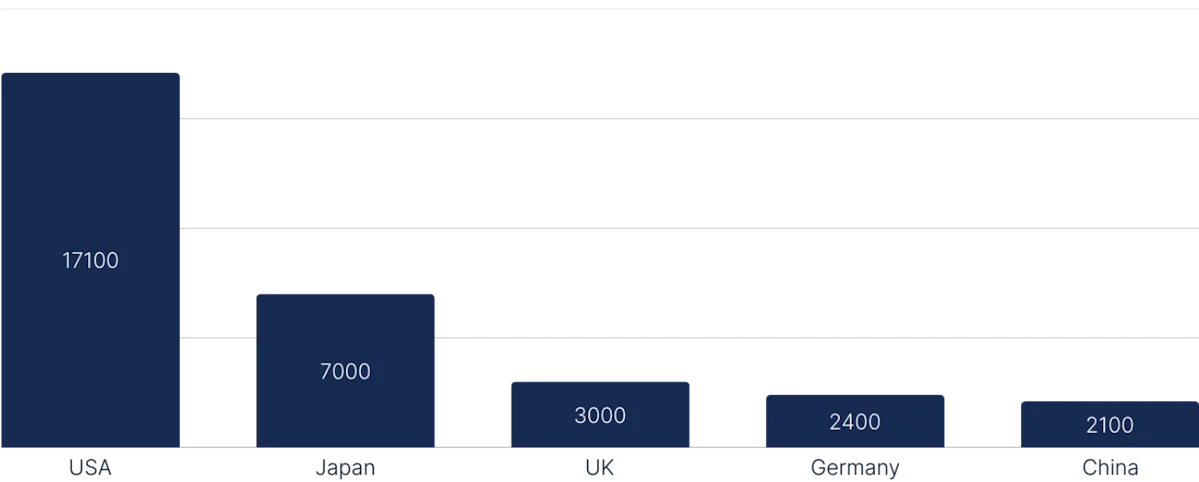

Despite the fact that Japan is the second largest music market (which is actually not that surprising for a country with the 3rd GDP worldwide and a population of 124 million), it remains one of the most misunderstood and challenging local industries in the world. That is for a good reason. With its unique cultural patterns and their effect on the market structure, Japan is very different from the Western markets.

Just a quick sidetone, before we get into it: If you're interested in a more first-hand insights into the Japanese market, check out our interview with Goshi Manabe, one of the leading experts on the local music business, who's spent the last 20 years building the bridge between Japanese music industry and the rest of the world.

Recording Industry Revenue by Country, US$ Millions, 2023

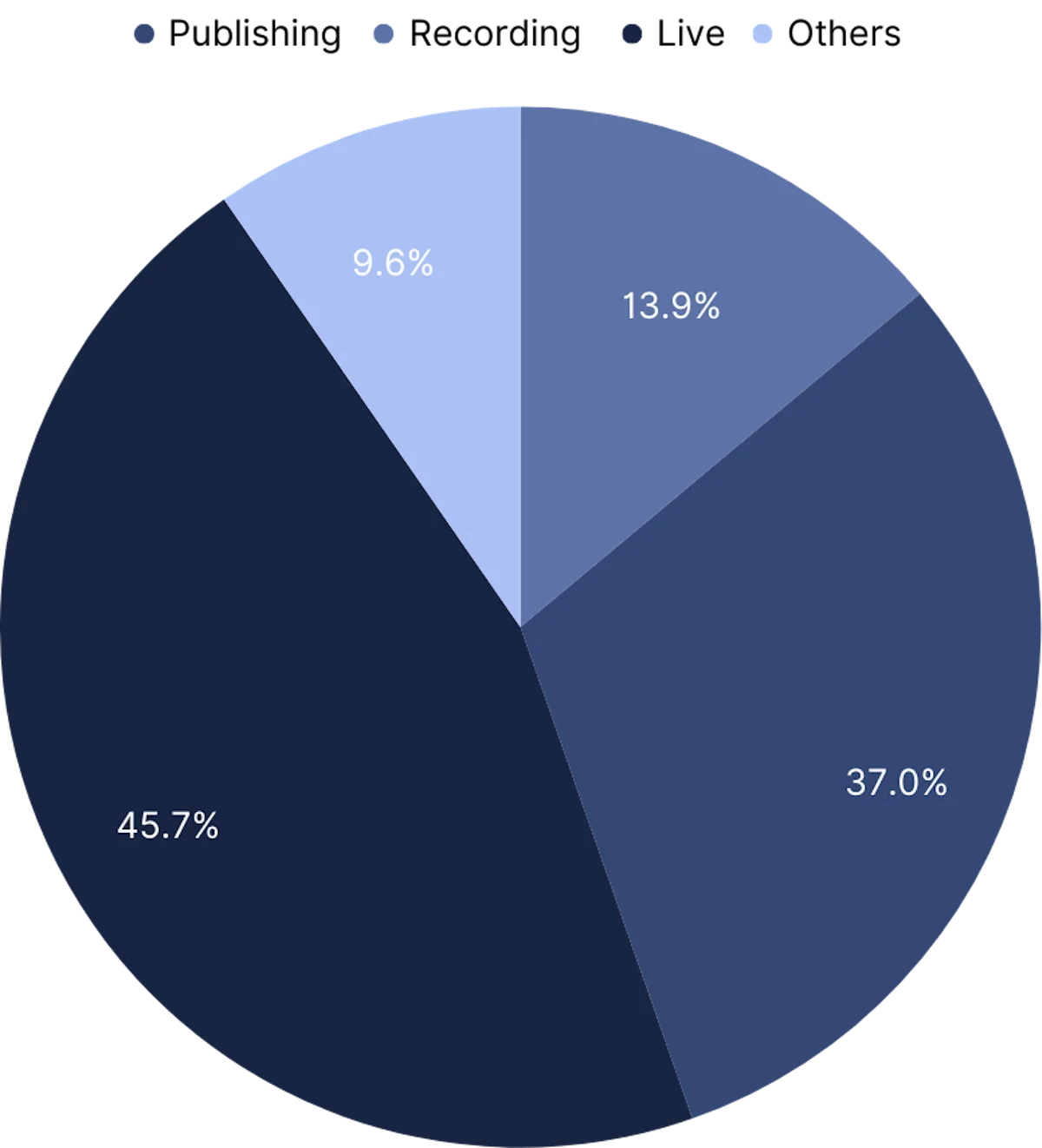

Structure of the Japanese Music Industry

Total revenues of the music industry are estimated at $7 billion, generated by 3 main sub-industries: live, recording and publishing. Over 90% of all live and recording revenues come from domestic acts, while publishing is considered the most foreigner-friendly part of the industry with 20-25% of revenues generated by international artists.

Japan Music Industry Revenue by Source, 2023

Live entertainment:

- Over $3.2 billion in revenues generated as of 2023.

- Growing steadily year-to-year, almost tripling the number of shows in the last 20 years.

Recording industry:

- $2.15 billion in music sales in 2023.

- Majority of recording revenues in Japan are still generated by the physical format sales (while the global music industry is 67.3% digital)

- Streaming services generate 34.5% of the music sales

Publishing industry:

- The most stable part of the market, generating $975 million

- The biggest parts of revenue coming from broadcasting, karaoke performance rights and advertisement content synch.

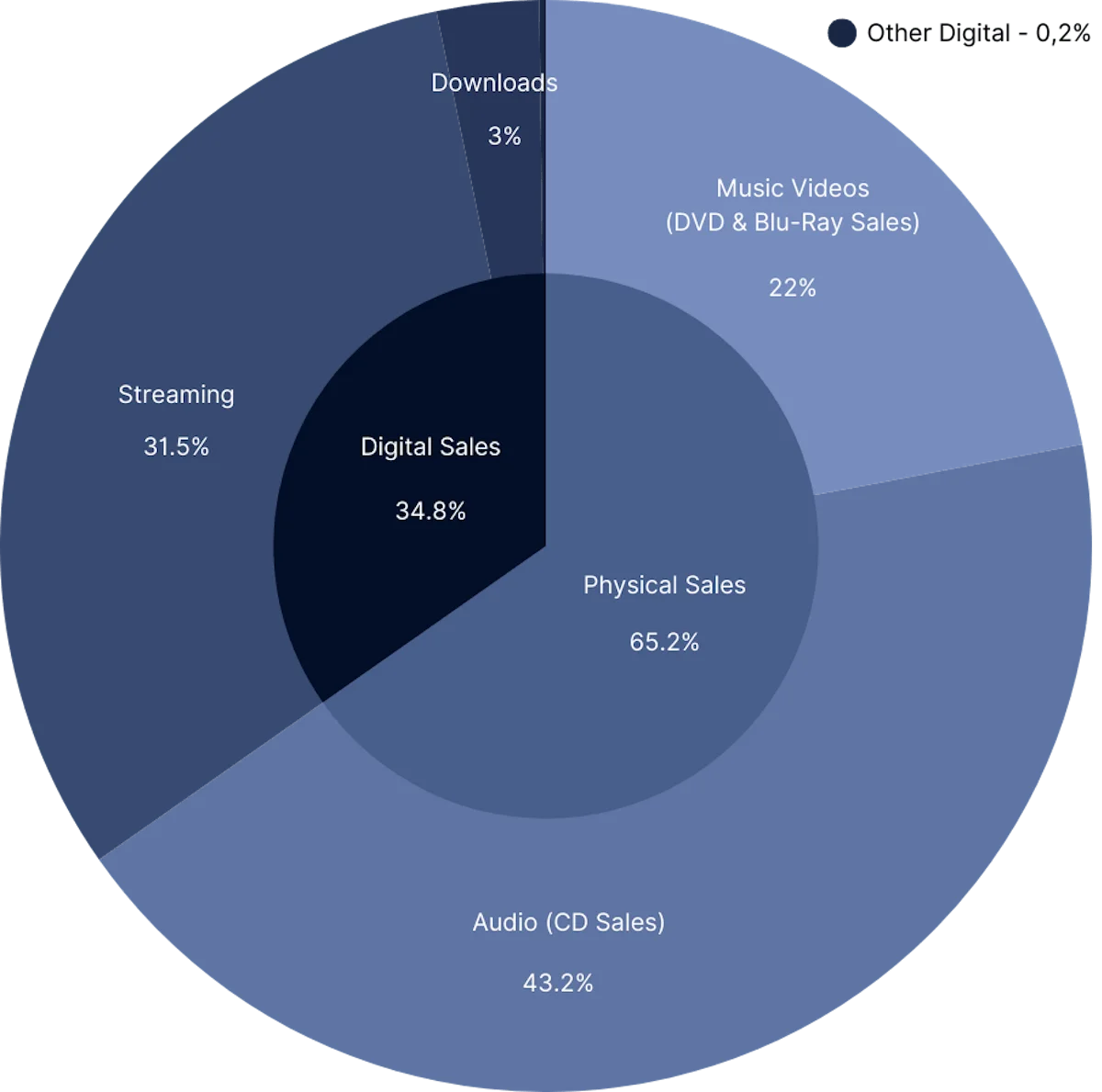

Japan Recording Industry Revenues by Source, 2023

Source: RIAJ Yearbook 2024

Japan's Recording Industry Explored

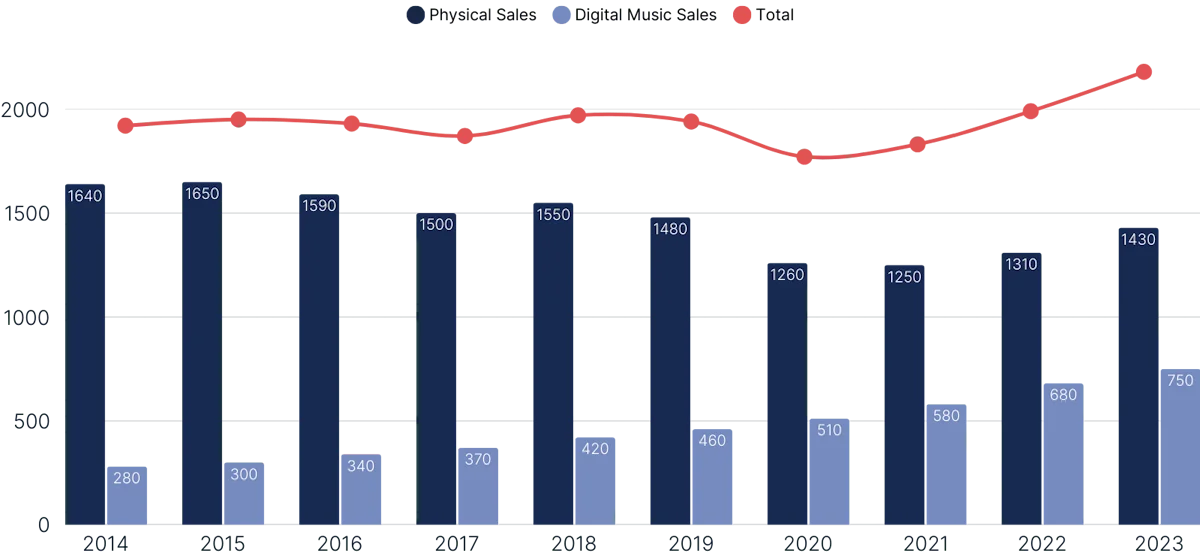

The recording industry in Japan was facing a big challenge: physical sales has been declining since 1998, and first growth of the digital formats couldn't offset that drop, until very recently. The recording industry has been consistently growing over the past 4 years (23%). Despite the availability of all global streaming services and a number of local solutions like RecoChoku, LINE Music, and AWA, streaming still struggles to penetrate Japan the way it did with most of western markets. That leaves Japan in a lingering transition phase.

As of February 2019, only 3 songs out of the top-10 of Billboard Japan Hot 100 were actually available on Spotify. Lack of local content on the platform means that potential customers can’t see the value of the service. As a result, streaming services couldn't get enough traction to convince labels to make their catalogs available for streaming and the cycle went on, creating an endless catch-22 loop. The problem is definitely being resolved, as some of the biggest local right-holders are changed their mind (or even introduced their own streaming services).

In the end, streaming is the only real answer to the decline of the physical market in Japan. The recent numbers, published by RIAJ, show noticeable growth of the streaming market over the course of 2024, as the audio-subscription and ad-supported video streaming revenues are up more than 100%. Overtaking the digital downloads as the main revenue source in the digital space, streaming shows a big promise – though it is still a long way to go until the new distribution models can really challenge the reign of the physical formats.

Japan Recorded Music Sales Evolution, 2014-2025, $US Million

Source: RIAJ Yearbook 2024 & 2019

While not impacting the revenue structure directly, streaming has already revolutionized music consumption. According to the Statista study conducted in 2023, the most popular way to listen to music in Japan is actually a streaming platform – 58.6% of respondents employed YouTube as the primary source for music discovery and consumption. The popularity of VOD also affects the importance of traditional channels. Radio in Japan has always been oriented toward the talk format rather than music broadcasts, and it shows – based on Guy Perryman, the low consumption of music over radio is due to Japan's culture, where many people use public transportation instead of driving, reducing typical "drive time" radio listening periods. Therefore, on-demand video content is probably the channel to focus on for international artists trying to make it in Japan.

Six-story Karaoke Kan in Japan

Another particular phenomenon in the Japanese market is the popularity of Karaoke. It is the favorite pastime in Japan and a huge industry, generating around $3 billion in 2023. While Karaoke revenues are not included in the music industry numbers, performance rights fees generated by Karaoke bars compose a substantial part of the publishing business, meaning that a Karaoke Hit can become a gold mine for the artist. Yet, as most Japanese don’t feel comfortable singing in foreign languages, this path remains mostly closed for international acts.

What Makes Japan’s Music Industry Unique?

While the statistics mentioned above allow to draw a general picture of the market, to understand exactly why the Japanese industry is different from the western ones we will now take a deeper look at the drivers of the industry, exploring unique cultural patterns of the Japanese market.

Fan-culture in Japan

Japan is notorious for having very passionate music fans. The fan engagement phenomenon is deeply rooted in the Japanese collectivistic, but highly competitive culture. Japanese fan often strive to be the biggest fan there is: feeling bad for not getting the limited edition release of their favourite idol's latest single, waiting in a line for hours at the meet & greet sessions, spending Friday evening at the Karaoke Bar with the friends from the fan-club and attaching great value to their relationships with the artist – it is not uncommon, for instance, for Japanese artists to get monetary donations in their fan mail, even though they never explicitly asked for it.

This is yet another reason for the limited success of the streaming services in Japan – their "all you can eat" approach just doesn't seem to fit well with the fans who want to support specific artists. Same goes for the rest of the Japanese industry, orchestrated by the fan culture: from the artist-related collectibles to the relentlessness of CD, it all seems to lead back to the needs and desires of the fans.

The Idol System

The second fundamental concept of the industry is Japan’s take on the mainstream music industry and the idol system. A vast majority of the mainstream acts in Japan are signed to management companies, such as AKS, and Amuse Inc. Such management companies operate on the basis of strict employer-employee relationships, meaning that when the artist signs a deal with the company, they become a regular employee, giving up all control over their public figure. That means that music executives have an unseen level of control over the artists, able to dictate their every decision, from their appearance to their love life. Although there is growing evidence of a shift towards more autonomy for artists, the traditional model of strict control persists. That unique environment is the essence of the idol system.

The idol system is widespread across East Asia, and you can't talk about the region without mentioning South Korea – 6th largest music market in the world. Despite the political tensions between Japan and Korea, cultural diffusion has made the markets very similar. Yet there is one notable difference between their approach: while Japanese artists are focused on the domestic market, their Korean counterparts are open to global opportunities. And, naturally, Japan becomes the first priority for the Korean acts: practically all big K-pop artists record two versions of their songs – one in Korean and one in Japanese, allowing them to go head-to-head with the local artists.

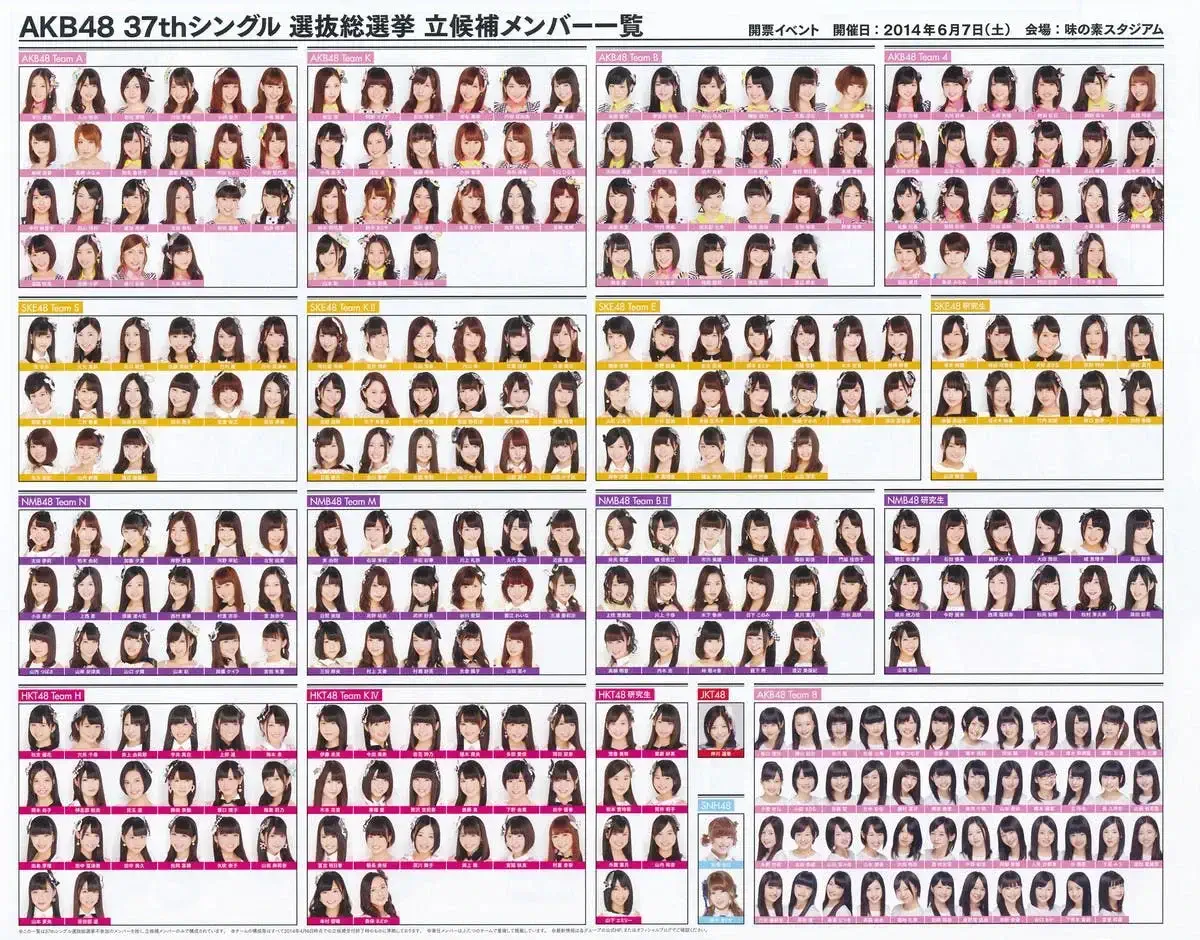

The idol system opens up unique possibilities when it comes to optimizing the star-production process. Some of the idol-bands are run by the management companies to create a continuous flow of new faces, serving as accelerators launching dozens of successful careers. One of the most popular Japanese idol-groups, AKB48 hosts more than 100 idols at a time – and while some of the more successful members of the band are "graduating" to start their solo acts, the new idols are recruited through numerous auditions all over Japan.

AKB48's full roster (37th iteration), split into teams.

The Industry of CD

Yet another aspect of AKB48's business model was illustrative of the Japanese market. Until 2018, the group was so big that all of its members couldn't possibly be featured on the same song or even the same album. So, AKB48 held a nationwide televised yearly election, allowing fans to decide who would be in the band's frontline. Yet, there was a catch: the right to vote was tied to the serial number of the group's latest "election single", creating an incentive powerful enough to make some fans buy hundreds or even thousands of AKB48 CDs at a time. Needless to say, with the average CD price across Japan at around $20, such techniques were highly lucrative.

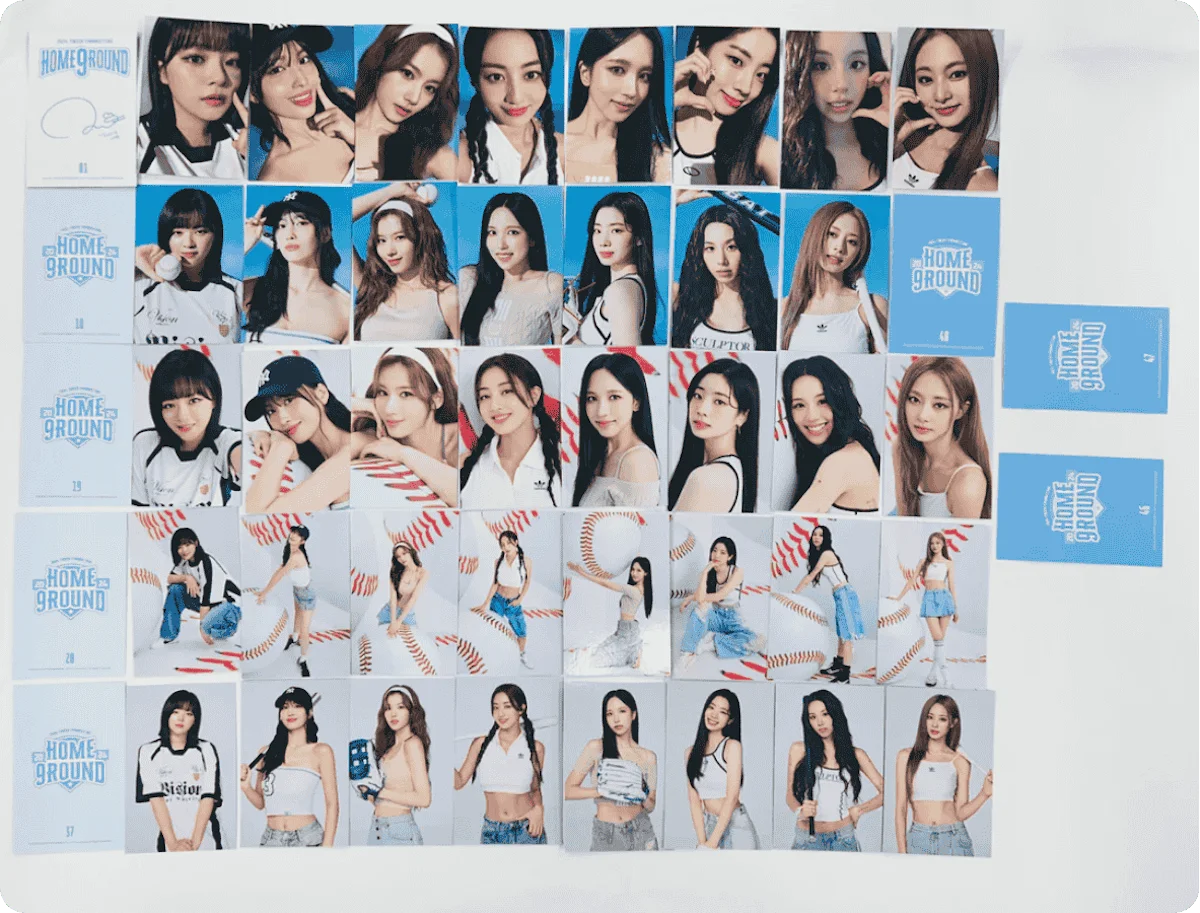

Adding value to CD offers to incentivize multiple purchases of the same content is a widespread practice in Japan. By far, the most common way of engaging with the format is by linking CDs’ serial numbers with a chance to win a meet-and-greet session ticket. Yet, some of the artists choose a more inventive approach, like the K-pop girl band TWICE, who have included a range of photocards in their CD packages. As the owners of the full collection were promised exclusive content access and tickets to meet & greet sessions, some fans made a full hobby out of trading and collecting idol cards. Yet the bonuses weren’t the only reason for that – by tapping into collectibles culture, which is very strong in Japan, TWICE added value to the CD offer and genuinely engaged the fan community, all at the same time.

TWICE "HOME 9ROUND" 9th anniversary- Official Trading Photocard, 2024

The Business of the Fan-Club

Another unique way to monetize fan engagement is linked to the "business of a fan-club". The fan-clubs are official communities with dedicated websites filled with exclusive content. As the access to content is usually subscription-based, such websites can generate a sizable amount of money, but, even more importantly, they allow fans to find like-minded friends and organize their appreciation, dedicating both time and money to their favorite idols.

To put it in a context, in 2018, the London-based fan-club of BTS pulled together a full-on outdoor marketing campaign to celebrate the 5th anniversary of their favorite band: numerous billboards, featuring BTS were put up all over London without a single penny invested by the group's label, making "UK ARMY" a part of a marketing team of the idol-band. The fan-clubs would often turn into such crowdfunding communities for the idols – once again, without the latter ever asking for it.

Billboard put up by BTS UK ARMY UNITE, South London, UK, 2018

The fan-club concept is probably the most globally spread business technique of the industry, as idols are now getting an organized following all over the globe. Meanwhile, some of the biggest international artists have already noticed the potential of the strong fan community, promoting a new way of proactive and engaged artist-fan relationships inspired by idol fandoms. Platforms like Weverse, initially popularized by K-pop groups such as BTS, have been adopted by Western artists like Ariana Grande to enhance fan engagement. These developments suggest that the "business of the fan club" is increasingly taking root in Western markets.

Local Players Knowledge-Base

On that note, we'd like to conclude our analysis of the market by sharing a last piece of knowledge. While having strong positions on domestic markets, most Japanese music companies are almost unknown outside of the country. Therefore, in the final section of this article, we will introduce some of the must-know players on the Japanese market (in alphabetical order).

Avex Entertainment Inc /Avex Marketing Inc

There is a good chance you haven't heard of Avex yet; Avex Group is the biggest local company in the entertainment industry, accounting for over $865 million in sales and engaged in various areas of the entertainment industry. Avex remains primarily a music company: with over 40 local labels under its umbrella, affiliation with AWA and Line Music streaming services, and a vast network of publishing and distribution deals, it is one of the most influential and powerful companies on the market.

Creativeman Productions

Responsible for introducing Radiohead, Green Day and Beastie Boys to Japan, Creativeman Productions is one of the most prominent players on live promotion market. Creativeman works with international acts of various scope and organizes some of the tier-1 festivals around Japan like Sonic Mania, Summer Sonic and Greenroom Festivals.

Hostess Entertainment

If you're interested in exploring the possibilities of the Japanese market as an outsider, the one company you definitely should know is Hostess. Founded in 2000 by the British expat Andrew Lazonby, Hostess is one of the leading players in the 10% international niche of the market, seeking to represent international acts which got what it takes to make it in Japan, giving them more control over the marketing side compared to their major counterparts. Hostess now represents Beggars Group, Domino Records, V2 Records and PIAS in Japan, working with Adele, Radiohead, Arctic Monkeys, Mogwai, Bon Iver, Nine Inch Nails, Superorganism and alike.

Victor Entertainment, Inc.

Founded in 1972, Victor Entertainment operates as a subsidiary of JVCKenwood and ranks fourth in the Japanese recording industry, surpassed only by Universal Music, Avex Group, and Sony Music Entertainment Japan. Home to over 20 local labels and over 400 regular employees, Victor Entertainment can be considered a “local major” on a par with Avex Group – and it’s certainly a notable player on the market.

RecoChoku

RecoChoku is the leading digital music provider in Japan. It’s stakeholders are all the major labels (both global & local), as well as NTT DoCoMo, Japan's leading mobile phone operator, which also offers D-Hits – a leading local streaming service in Japan at the moment. If you're curious to find out more about RecoChoku and the Japanese market in general — check out our interview with Goshi Manabe, RecoChoku's International Rep & Advisor.

SMASH

On a level with Creativeman, SMASH is another major local promoter on a Japanese market. Responsible for running the Fuji Rock Festival, which attracts more than 100,00 attendees, SMASH works with both local and major international acts from Kendrick Lamar and Post Malone to Aphex Twin and Bjork.

Tower Records Japan Inc.

Tower Records Japan was created in the 80s as a subsidiary of the legendary international retail franchise of the same name, but went through the management buyout and became an independent entity in 2002, just four years before the bankruptcy of its parent company. Now it is the biggest retail store chain in Japan, with more than 72 stores spread all over the country, an online download-to-own distribution platform and over 550 full-time employees. As CDs is still a dominating force in the Japanese market, POS marketing remains a very effective way of promoting music, and a partnership with retail chains such as Tower Records can prove remarkably fruitful.

The companies mentioned above, however, represent just a fraction of the Japanese industry. To get a deeper view of the local players, explore the following list:

Other Local Companies

1. Record Labels

- Being

- King Records

- Nippon Columbia Co. Ltd.

- Pony Canyon

- Teichiku Entertainment

- Toy’s Factory

- Yamaha Music Communications

2. Retail Store Chains

3. Publishing

- Fujipacific Music Inc.

- Nichion, Inc.

- NTV Publishing

- Shinko Music Entertainment Co. Ltd.

- TV Asahi Music Co. Ltd.