The U.S. music market is not only the largest market in the world. The influence of the U.S. spreads far beyond the country's borders, securing its place as a trendsetter of the global music industry. As of December 2024, 66% of the songs on Spotify’s Global Top-50 playlist were recorded by US-based artists. American acts are leading the industry, but, at the same time, the American music market itself is often left somewhat under-explored by the international music community. It is easy to write it off as entirely globalized – while the industry is actually full of surprises and local quirks when you get to the bottom of it.

Sizing the American music industry

It’s not always clear where to draw the line when sizing the music industry. The broad definition will include not only the actual customer’s expenses (on concert tickets, streaming subscriptions and so on) and B2B licensing cash flows, but also ad-revenues of radio and other music-related media. That definition will put total revenue of the U.S. music market at whopping 61$ billion.

Under a more conservative approach, however, only a fraction of radio revenue will be included in the music industry in the form of royalty payments. In the U.S., however, even that won't be exactly the case, as American radio stations don’t pay out performance royalties to recording artists, stating that they provide “free publicity and promotion to the artist”. Accordingly, the US radio only compensates the owners of the composition — songwriters and their publishers. So, adopting a more precise definition, the industry's revenue can be estimated by summarizing the cash flows of the following core businesses:

Recording industry:

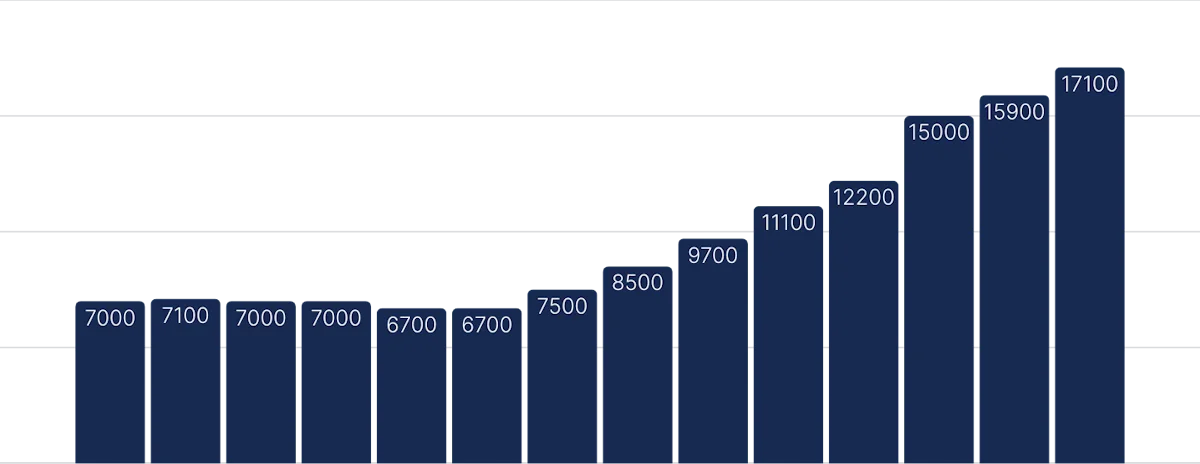

- The recording industry is growing, and revenue is up 7.7% in 2023, reaching a record high of $17,1 billion in retail value.

- That growth is primarily powered by the streaming services. Over the same period, streaming revenue went up by 9%.

- In 2023, streaming accounted for 84% of the total recording revenues.

US Recording industry revenues, 2010-2023, US$ million

Source: Recording Industry Association of America

Live industry:

While the recording industry is precisely measured, there is no consensus when it comes to the live sector's revenue. The estimation becomes problematic due to various reasons, from the complexity of revenue attribution to the volume of the secondary ticket market. As a result, revenue estimations vary between the different sources.

- Drawing primarily from Mordor Intelligence estimations, the total revenue of the live industry is projected to reach $15,6 billion in 2025.

- Around 80% of live revenue comes directly from ticket sales, while brand sponsorships and merchandise generate another 20%.

Publishing industry:

- According to Music Business Worldwide, publishing generated $6,2 billion in the U.S. in 2023, jumping 10,7%.

- Overall publishing revenue increased 9,8% throughout 2023.

- This growth is primarily driven by the surge of performance royalties, connected to the rise of streaming.

Summarizing the cash flows of recording, live and publishing segments, total revenue of the U.S. industry can be put at around $39 billion.

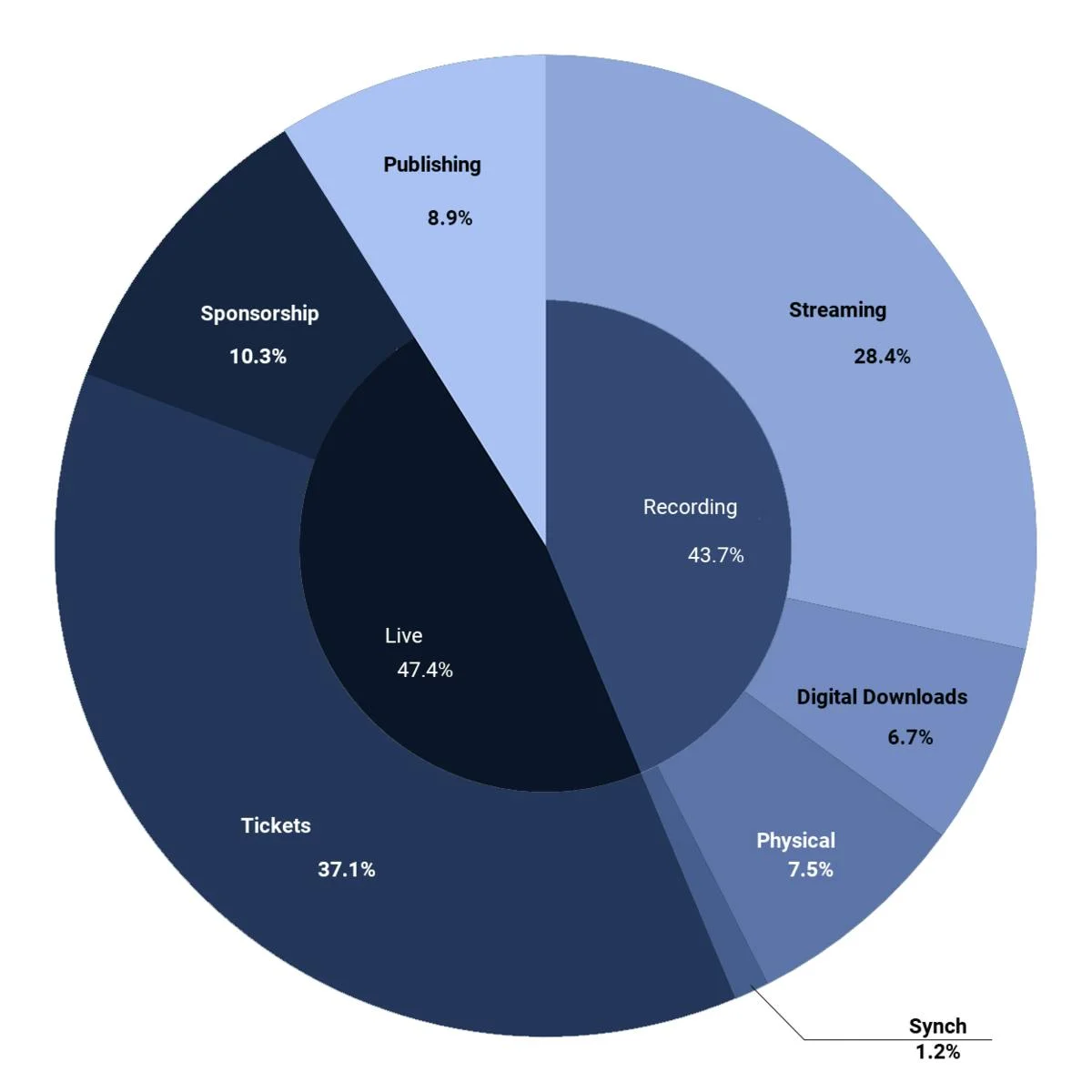

U.S. Music Industry Revenues by Source, 2017

Source: RIAA, Citigroup, PwC, MIDiA Research

Streaming is King

The U.S. music market seems to be utterly reliant on streaming as the music consumption medium. RIAA states that it accounts for as much as 84% of all recording revenues, while the global average is at around 67%. The U.S. has completed its transition to the new music distribution paradigm: Drake’s Scorpion takes the top spot on the BuzzAngle's end-year chart with 500 thousand CD sales vs. 6 billion on-demand streams, and A Boogie Wit Da Hoodie’s SZN reaches the #1 on Billboard with just 823 album sales. However, don’t rush to the conclusion. The structure of music consumption is not that simple.

Radio in the digital age

A big chunk of consumption is not reflected in the industry revenues. As previously mentioned, terrestrial radio doesn’t contribute directly to the industry’s revenues, as the U.S. law rules that the promotional effect of airplay is enough to compensate right holders. At the same time, radio remains the most powerful medium in the U.S, reaching 82% of Americans every week. This reach is high, but those ~80% figures have decreased over the last decade, dropping from 89% in 2019. To put it in perspective, according to Nielsen’s research, throughout 2023, nearly 70% of consumers' daily ad-supported time was given to radio, 20% to podcasts, and the rest to streaming and satellite radio.

Radio broadcasts, of course, are not exclusively limited to the music programming: news, talk shows and other non-music content were always the vital components of airplay. Still, though, the role of radio as a consumption channel can’t be underestimated. Essentially, it remains the primary music medium in the U.S. up to this day. But what are the reasons for such strength of radio, the media that seems to be outdated in the country with the highest streaming penetration rate?

The power of the Airplay

The radio industry is powered by both cultural specificity and the localized nature of the market. First of all, the U.S. is one of the most geographically fragmented music industries. The fourth largest country in the world, stretching across more than 9 million km2, the U.S. is built on the principles of decentralization. Both political and legislative landscapes of every state are different, and this is a reflection of the deeper-level cultural versatility.

To a certain extent, every distinct part of the United States has its own cultural and media setting, and music is a big part of it. That decentralization doesn't necessarily stop at a state level: Nielsen, for example, highlights no less than 210 DMAs (Designated Market Areas) as singular territories where “population can receive the same television, radio and broadcast channels”. Such fragmentation affects the music industry in a significant way – numerous studies have highlighted the variation of music preferences across the U.S, from overall genre tastes distribution to the popularity of selected artists.

In other words, the U.S. is more like a group of local conjoint markets than a homogeneous industry. Of course, there are broadcast networks that connect the country's media-space, which are a crucial tool of artist promotion on a national level. Coast-to-coast broadcasts can offer nationwide reach, and shows like Saturday Night Live are notorious for propelling music careers into the next league. Still, though, there is a good reason why no country musician has ever come out of New York – and here is where radio shows its strong suit.

The localized nature of airplay allows radio stations to engage with the regional cultural context, and that is something that global, unified streaming cannot offer (at least not yet). Radio broadcasts are curated, localized and increasingly interactive, and this is precisely why radio can compete on par with streaming services of all scopes. That localized nature also makes radio airplay data a massive source of insights for music professionals — which is why Soundcharts currently tracks over 2,400 radio stations in 86 countries across the globe.

On top of that, due to the geographical spread, dominant cultural tropes and lack of public transportation in specific regions personal automobile remains the primary mode of transportation in the country. United States has one of the largest numbers of cars per capita, with 291,1 million vehicles in operation as of Q2 2024. Such car population also plays in radio’s favor: around 70% of Americans name terrestrial and satellite radio (SiriusXM and alike) as the leading in-car audio source. At the same time, all of the primary streaming services now offer solutions for in-vehicle listening, from Apple’s CarPlay and Google’s Android Auto to Spotify's onboard integrations, making “the Car” the main battleground of a “radio vs. streaming” standoff.

The Future of Radio

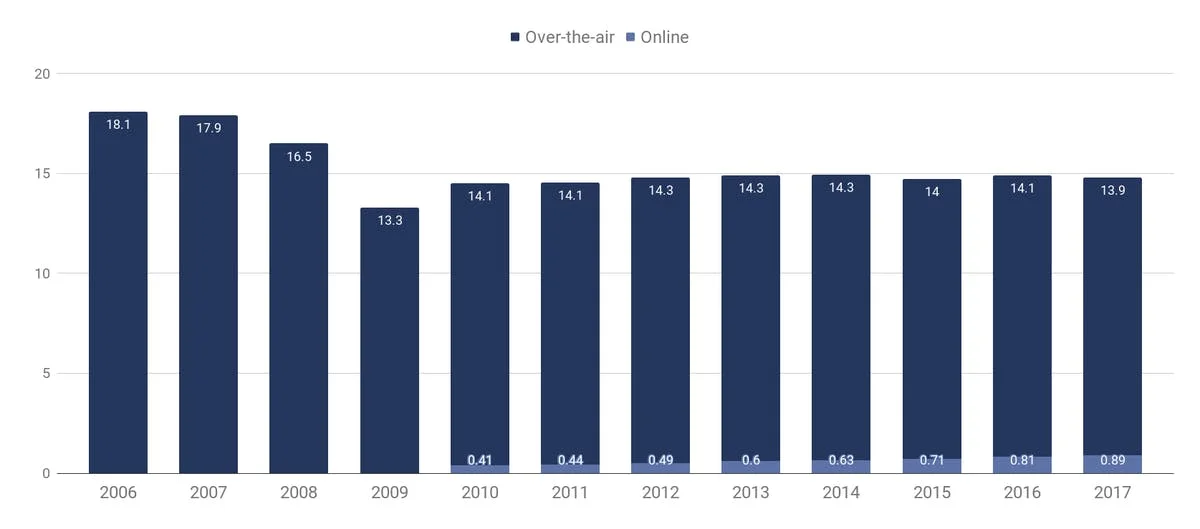

Although radio is the first medium for audio consumption, the combined revenue of the U.S. stations remains stagnant over the last years, as the growth of digital advertising and the slow decline of airplay cash flows balance each other out. This stability is expected of the mature market such as radio industry, but at the same time, as the iHeart bankruptcy showcases, even some of the largest players on the market struggle to find a stable financial model.

Radio station revenues in the U.S. 2006-2017, $US billion, by source

Source: BIA/Kelsey

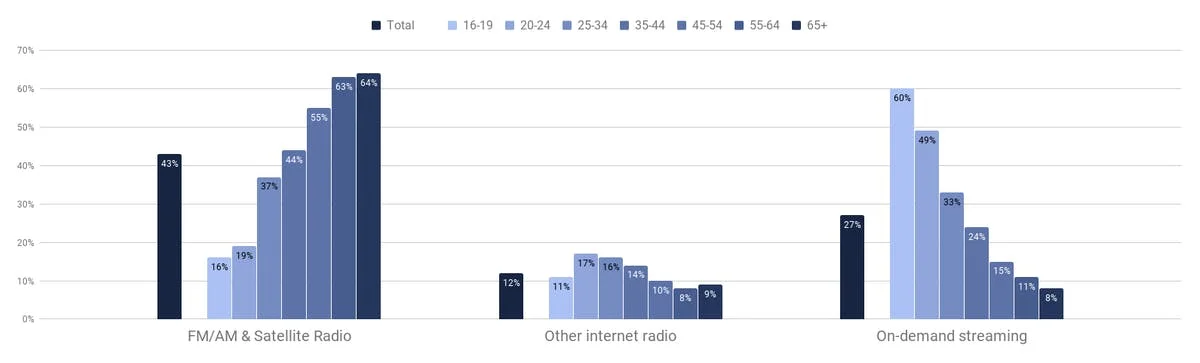

The challenge of the radio industry is not that the revenue or even consumption is down, but that the streaming has been growing in double digits for years in a row now. On top of that, the age profile of the radio audience is almost diametrically opposite to the demographics of streaming users: while 16-25 y.o is the top streaming census, radio thrives within the demographics from 35 y.o. and up. This rapid aging of the audience is often referred to as the main threats of the industry, as the question of whether or not radio stations will be able to engage younger listeners remains open. In that regard, If the radio fails to take on the streaming generation, we might see a rapid decline in the sector’s revenues in the coming years.

Time spent listening to music via selected sources in the U.S. 2018, by age group

Source: Audiencenet, Music Business Association.

Radio and Music Consumption

For now, however, the radio keeps its prominent position. According to the Edison Research study conducted in Q3 2024, listeners aged 13 and older spend 32% of their music-listening time with radio (including both airplay and digital streams of the radio broadcasts), surpassing on-demand streaming with 28%. This indicates that, despite the growth of streaming platforms, traditional radio remains a primary source for music listeners in the United States.

Over 57% of Americans also use radio for music discovery. In that sense, the U.S. industry is a combination of digital and physical worlds: while streaming takes center stage when it comes to the revenue structure, traditional media are still as relevant as ever, and airplay remains the first promotion and consumption channel in what seems to be an entirely digitized industry.

However, there is still one point in the U.S. music industry that needs to be explored. Since the age of piracy and up to the explosion of streaming, the live performance was considered to be the primary revenue stream for any artist out there, to the point where all other activities would be seen as the way to promote concert tickets. Yet there is a segment of the U.S. live industry that has evolved to become a massive promotion channel not only in the States but all over the globe – top-tier music festivals.

Coachella Effect

The chances are that even if you live outside of the U.S. and never visited the country, you’ve still heard of Coachella, Lollapalooza and South by Southwest. If you are an EDM fan, you probably know EDC and ULTRA, and if you are into country music – you might be planning a pilgrimage to the CMA Festival (although that is a long shot). The biggest U.S. festivals have become global brands, not only attracting international crowds to the U.S. but exporting the events themselves overseas. ULTRA festivals are now available to fans in 43 locations across six continents, and throughout 2019 you can catch Lollapalooza in 7 different countries from Brazil to France and back.

To further blur the borders, the top festivals are now becoming major online events on top of physical ones. Even though Coachella is known to draw over 200k visitors at a time, the local attendance is only a part of the festival’s reach. Digital presence can, in a way, double or even triple the total attendance: in 2018, for example, Coachella generated more than 166 million YouTube views, with the new multi-view feature allowing up to four live performances to be streamed simultaneously.

A Crowd at Coachella

Photo by Karl Walter/Getty Images for Coachella

Besides that, the spot on the first league festival lineup promises an artist more than just an opportunity to make money and get new fans (although those two factors can be very significant). Playing a major festival puts an artist on the map. It immediately draws the eyes of promoters, festival programmers and overall music professionals from all over the world – which is why top U.S festival performance is often considered a groundbreaking milestone, especially for international up and coming artists.

Local Context of the Global Trendsetter

The U.S. is still the primary producer of the global music context. Hip-hop has started in New York in the 70th and the first rock’n’roll song was recorded in Memphis in the early 50s. Blues, Jazz, you name it – most genres that ruled over the popular culture since the early 20th-century have originated in the U.S. That can sometimes make it hard for an outsider to assess the country's music landscape. We all know of the local genres spread over the world: France has Variété Française, Korea has K-pop and so on. However, when it comes to the U.S. we often think along the lines of “all the international genres are American, so all American genres are international”, while there's a substantial part of the U.S. context that just doesn’t cross over the ocean.

A “Honkey-Tonk” in Nashville, TN

Photo by Chuck Dauphin for Billboard

The Country of Country

Country music is a perfect illustration of that. The genre is almost non-existent outside of North America. At the same time, it’s hugely popular in the U.S: as reported by TSE Entertainment, country is responsible for 14.7% of the market shares. It has experienced a 23.5% increase in streaming in the past year. However, there are reasons to believe that the genre popularity spreads far beyond that scope.

Internationally, the genre is gaining traction. In the United Kingdom, country music has seen a substantial rise, with sales and streams of country singles increasing by nearly 66% in a single year. Additionally, countries like Australia and Germany have witnessed growing interest in country music, with artists performing to large audiences and festivals attracting significant crowds.

Once again, the airplay showcases the layer of the U.S. market, which might not be apparent at first glance. The decentralized nature of the U.S allows for multiple music contexts to coexist and develop in parallel. The internet-centric hip-hop artists might be able to sprout up to the top of Billboard charts with next to no airplay and no backing from record labels, but that doesn’t mean that radio doesn't matter anymore. The key to understanding the market — and your place on it — is in assessing the full picture: going beyond the primary recording revenue structure and exploring the musical landscape across all consumption channels and regions.

And no tool gives you the 360° view of the artist career quite like Soundcharts does. Our platform tracks radio airplay in 85 countries across the globe (including 500+ major US radio stations), streaming consumption and playlists, social media audiences, online press mentions, and thousands of digital charts to give you a complete, automated report of an artist career — for any of the 12M+ artists in our database.